a classic exercise that we often encounter in business school, or elsewhere in higher education: the professor proposes, “I have two tickets to the Taylor Swift concert this Saturday night. All of you should write down on a piece of paper the maximum amount they’d be willing to pay for these tickets, then turn them in, and we’ll look at the distribution of those prices.” The idea is that from there, a promoter should be able to determine the optimal price (or sets of prices) to charge in order to maximize their sales.

Now, what typically happens is we see a distribution of numbers get passed in. Some are willing to pay lots, others not so much, and a bunch of people lie somewhere in the middle. We often see these numbers form something like a Gaussian distribution, or as it’s known to the general public, a ‘Normal Distribution’. Why do we see this distribution a lot? And why is it called ‘Normal’?

(Editor’s note: I play fast and loose here with what a ‘Normal’ distribution technically means here. If you’re mathematically inclined, kindly replace the words Normal and Gaussian with ‘Unscientific Lumpy Middle’ and the points should still hold just fine.)

We see this distribution all over the place: in nature, in business, in life. If you’ve taken high school biology, you’ve probably encountered this picture:

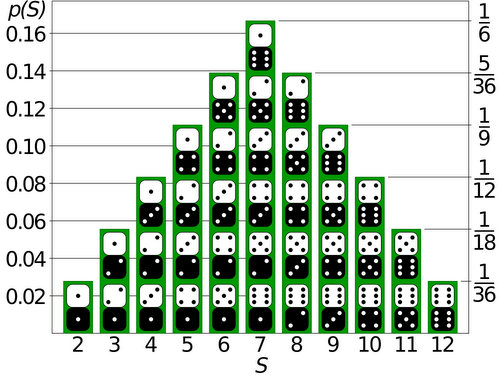

There’s a good reason why the normal distribution pops up so much: it represents the sum of some number of component factors. If you’ve played the game Settlers of Catan, you’ll be very familiar with this phenomenon: the outcome of the total roll of the dice, which represents the sum of one die plus the other, follows an approximately normal distribution. If you were rolling five dice instead of two (like in Yahtzee), you’d see this distribution more clearly. If you’re dealing with hundreds or thousands of factors (like human genes), you see normal distributions arise for things like our height. Even when some of these factor are inter-dependent, as is certainly the case with our genetics, we still reliably encounter these distributions: whenever we encounter the sum of many factors, there they are.

It should make sense that our stated prices for these Taylor Swift tickets should follow a distribution like this: you could think of it as a sum of many factors. How much did you like 1989? How much disposable income do you have? How far would you have to travel? What are your other options? Would you have friends who would go with you? And so forth. We can generalize this example to our preferences and choices generally: the decisions we make whenever we spend something (money, time, opportunity, etc) represent the sum of many factors. Suppose you’re shopping for a new car: the distribution of new car prices aren’t quite symmetrically Gaussian (there’s a long tail towards the high end), but it’s still Normal-ish. If you’re looking for a car as a young person, you’ll have a certain set of factors you consider – cost, value, practicality, style. As you grow up, these factors will change, but the decision will remain multifactorial in nature – many of your preferences will evolve, but along a similar set of variables. Some of us buy luxury cars, others buy the cheapest that they can, and most of us are in the big fat middle – like rolling two dice and landing somewhere between a 4 and a 10. It won’t happen every time, but it’ll happen most of the time.

There’s just one problem with this principle: it’s vanishing.

Consider these three situations:

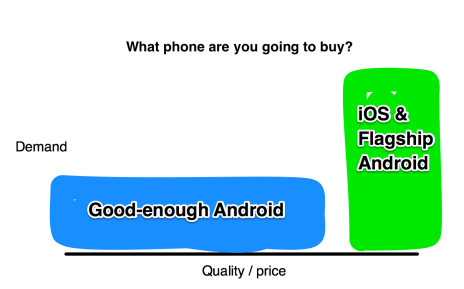

1. You’re looking to buy a new smartphone. What does your demand distribution look like? Is it normally distributed? Absolutely not. It looks like this:

Chances are good that if you’re in the market for a smartphone, you fall into one of two very clear cut categories. Either: a. you’ve decided that your new phone is a very important item in your life, so you’re going to buy the nicest phone available at whatever price. (Usually this means an iPhone, although some flagship Android phones qualify for this category.) Or, b. you’ve decided that just about every phone out there is ‘good enough’ and is more than adequate for your needs, so you’ll go with whatever one costs $0 with your existing wireless contract.

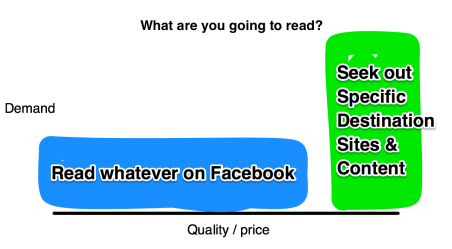

2. You have twenty minutes of free time to spend reading things on the internet. How will you choose to allocate your attention? Odds are, it looks like this:

Stratechery. But either way they’re a destination site – you’ve chosen explicitly that they, and precisely they, are what you’re going to read. Or, b. you don’t choose anything at all; instead you had to Facebook, Twitter, Reddit, etc and just browse through whatever’s posted there. Often it’s content with broad, mass appeal like Buzzfeed or Vox that no one is looking for directly, but many are happy to click and read.

3. You’re a recent college graduate trying to decide where you’ll live. How will you make this decision? Will your options and preferences be normally distributed? Probably not. Odds are, your decision looks like this:

Chances are good that your decision will fall into one of two categories. Either: a. you’re trying to break into the film industry, so you’re overwhelmingly drawn towards LA. Or you’re trying to join a tech startup, so might be drawn to the Bay area. Or for any number of reasons. you just have to live in New York. And you’re willing to put up with all kinds of horrible side effects in order to live in that exact right place. Or, b. You will move anywhere where you get a job, or get into grad school, or where your girlfriend is moving – it’s effectively a single-variable decision.

These aren’t normal distributions at all. They’re totally different – they’re bifurcated distributions where one factor is dominating over all of the other factors. Either you care about X, or you don’t. Either you care about Y, or you don’t. And what used to be the happy middle – the fat part of the normal distribution, where most of the demand is supposed to lie – is all of a sudden quite sparse.

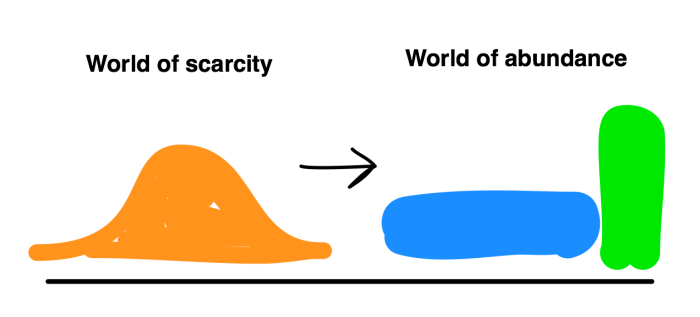

The world seems to be steadily moving in this direction: from one where our demands and preferences are normally distributed to one dominated by these weird, bifurcated, two-tier balances. Why is this happening?

My hunch is this: The world’s shift from Normal, Gaussian distributions of demand towards bifurcated, two-tiered distributions is a natural consequence of our shift from a world governed by scarcity to one governed by abundance.

In a world governed by scarcity – which is the one we’re used to thinking about, and the one described in our economics textbooks – it makes complete sense for our purchasing and preferences to be multi-factor considerations with normally distributed outcomes. This is because when X is scarce, our default position towards X is ‘potentially interested, if the price / conditions are right’. We consider many factors when determining whether conditions are right, so our preferences and decisions are multifactorial in nature – that’s why we see normal distributions so consistently.

But in a world governed by abundance, it’s all different. When X is abundantly available in many different places and forms, our default position towards any given X is ‘not interested’ unless something specific changes our minds. These aren’t multifactorial decisions – they’re usually dominated by one single factor whose influence trumps everything else. If you care about your smartphone, you’re going to get the nicest one; if you don’t, you’re going to get the cheap one. If you have something specific you want to read, you’re going to read exactly that; otherwise, you’re just going to scroll through Facebook and read whatever. If you care about living in New York, you’re probably ready to make a lot of concessions in order to live there; if you don’t, then there’s no chance. If you’re a Taylor Swift fan, you’re probably willing to pay a lot of money for those tickets; if you aren’t, then there’s a good chance you aren’t willing to pay any money for them because even if they were free, you’d rather do something else on Saturday night anyway. The normal distribution is disappearing: we’re in a new world where either you care about something, or you don’t. The middle ground is vanishing.

So what can we do with this idea?

The first thing to do, in my view, is to look for areas of the world where our preferences are still normally distributed. Then ask: is this because we’re still operating on scarcity-based principles? And if so, are we headed down the road towards abundance-based principles? If so, what can we expect in the future?

Here’s one example: personal banking. Our personal banking requirements are still being served by a big, fat, normally distributed group of companies and services. How come? Is it scarcity-based demand? Well, it certainly isn’t because of actual scarcity. With the birth of online banking and creative partnerships with distribution channels, it’s entirely possible to do your basic banking through any number of online, cheap and functional banking institutions – not to mention the multitude of brick and mortar branches that are all around us, competing for our business.

Some people have genuinely complex banking and credit requirements. Others don’t. And in a world where banking services are abundant – which I believe we’ve entered, at least in the western world – I’m guessing we’re headed towards a similar iOS/Android style bifurcation. At the high end, we’ll see companies and services like American Express – the iOS of cards in my wallet. But what about the low end? Who’s issuing the basic, cheap, functional personal credit – the low-end Android?

Right now it’s other banks. But it doesn’t need to be. Banks are expensive to run (especially those with a big physical presence at brick and mortar branches); they’re built for the normally distributed world with its fat middle. But they’re not built for this new, bifurcated world – many of them can’t compete at the low end or the high end; they’re not sophisticated enough to compete with Chase and Amex, but too operationally expensive to compete with an online-only credit union.

someone like Walmart, who already has customer loyalty, the ultimate physical channel, and the resources to make it work? Or maybe, in developing countries whose residents are still unbanked, the wireless carriers? Or maybe emerging payment companies like TenCent, or AliPay, could become effective creditors themselves?

comes true, we could be living in a world where the majority of people do not own their vehicles; they simply use them and enjoy access to them. It’s reasonable to speculate that these vehicles, likely owned in fleets, won’t be fancy – they’ll be vanilla Android cars. But there will probably also be another ‘class’ of vehicles – the iOS cars – for those who still care about owning or using a premium vehicle. These might include luxury cars, special work vehicles, or collectors’ items – the important unifying factor being, these vehicles are

owned by people who

care about ownership, whereas the vanilla fleet will be used by people who don’t care about fancy ownership – they just need to get places. Either you care about X, or you don’t.

her famous WSJ op-ed last year – part of what makes music special is the contingent of fans who

do care, and continue to faithfully buy specific artists’ records even while they stream others’.) Or do you listen to her from time to time on Apple Music, and that’s enough?

Are you sufficiently well off to pay an old-fashioned, prestigious university degree? Or do you simply need access to online course material and learning opportunity? There’s little doubt that our higher education system will see some sort of shakeup in the next few decades, and to me this looks like a potential bifurcation situation: colleges and universities are getting way too expensive across the board; and yet, students who pay top dollar and go to prestigious schools usually do well! And furthermore, the amount of online learning opportunities available are exploding – that’s not the problem either. The issue is the big, fat middle that doesn’t serve anybody particularly well – and is sustainable for the most part because we feel like it’s important. We’ll see how long that lasts. (It could be a while, though.)

Does your company need to lock down a particularly valuable employee to a long-term contract? Or does it simply need access to a steady stream of available talent? For the most part, we don’t get a clear view into how top performing companies structure their compensation from the top all the way down to the bottom – usually we hear about the executive suite and that’s it. But there’s a great exception: professional sports teams, where team salary and cap hit information is usually available. And on these teams, we’ve seen this same thing emerging: either you’re a star, or you’re replacement level. The middle ground is vanishing: either you’re locked up to a multi-year blockbuster deal, or you’re on a one-year, market rate contract that’s pretty indistinguishable from any other. Outside of the sports leagues, where we don’t have such a privileged view, is this happening as well?

We can see, too, that these bifurcations are driven by a shift from a world of scarcity to a world of abundance. Buying an album used to be the only way to listen to your own music – now it streams online, quasi-free, always. Learning material used to be precious and valuable – now it’s abundantly available online, everywhere. Employee retention used to be critical for companies from top to bottom – now freelance and temporary labour is abundant, and only the truly scarce need be locked down. These decisions, which were once multifactorial, are becoming single-variable: either you care about X, or you don’t.

There’s a dark side to this idea: its sinister cousin, economic inequality. We typically celebrate and value an upwardly mobile society with a “healthy middle class”; in other words, a society whose incomes form a Gaussian distribution. But in a world shifting towards one of abundance, where one would hope that rising tides would lift all boats, could this bifurcation be slowly and irreversibly happening as well? Are we heading towards a two-class system: a class of owners and a class of users? I’ll save this question for part three: I still have a lot of personal research to do before I’m able to properly form an opinion here.

In summary, what can we take away from this?

-Normal distributions come from multifactorial situations, where many variables matter.

-In a world governed by scarcity, our decisions and preferences tend to be multifactorial in nature.

-In a world governed by abundance, on the other hand, our decisions are no longer multifactorial. They tend to be dominated by one factor above all others: either X matters to you, or it doesn’t.

-If the world is moving in this direction, we might anticipate other industries and ecosystems that could follow. Education, cars, banking, and employment come to mind as examples; there are many more.

-The fall of the normal distribution maps to the rise of the access economy: ownership and access are not part of the same distribution; they are two halves of a bifurcation.