ProPublica is a nonprofit newsroom based in New York. Sign up for ProPublica’s Big Story newsletter to receive stories like this one in your inbox as soon as they are published.

Despite signing a deal with the IRS that pledged they would help tens of millions of Americans file taxes for free, tax software giants Intuit, the maker of TurboTax, and H&R Block instead deliberately hid the free option and actively steered customers into paid products, according to an internal document and five current and former employees of the companies.

H&R Block explicitly instructs its customer service staff to push people away from its free offering, according to internal guidance obtained by ProPublica.

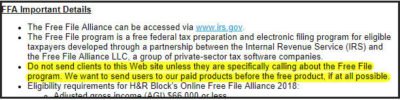

“Do not send clients to this Web Site unless they are specifically calling about the Free File program,” the guidance states, referring to the site with the company’s free option. “We want to send users to our paid products before the free product, if at all possible.”

Steering customers away from TurboTax’s truly free option is a “purposeful strategy,” said a former midlevel Intuit employee. For people who find TurboTax through a search engine or an online ad, “the landing page would direct you through a product flow that the company wanted to ensure would not make you aware of Free File.”

When the Free File program launched 16 years ago, it was extolled as the best sort of collaboration between government and private enterprise. With little cost to the IRS, the huge companies that dominate online tax preparation would help millions of Americans file their taxes for free. Intuit and the industry have spent millions lobbying to make the Free File program permanent because it contains a noncompete provision that restricts the IRS from creating its own free, online filing system.

But privately, the free filing option is seen for what it is: a threat to the companies’ profits.

So the companies had to strike a delicate balance: They wanted to preserve their arrangement with the IRS to ward off government competition, but then they also sought to make sure the program didn’t recruit too many customers who actually got something for free.

The companies set out to convert people who qualify for the program into paying customers. Sure enough, use of the Free File program has collapsed. Soon after it was launched in 2003, more than 5 million Americans filed their taxes for free. Now it’s about half as many, according to the latest IRS data.

The industry has also succeeded in fending off a pair of grave dangers: the prospect of the government either creating its own easy online filing system or offering tax returns pre-filled with data the IRS already has, a practice common in other countries.

Now Intuit and H&R Block could be dealt a setback. A bill that would codify the Free File program, which passed the House last month, has stalled in the Senate after ProPublica reported that the companies were making it more difficult for people to find their Free File websites by hiding them from search engines.

Both companies employ similar tactics: They lure customers in with products advertised as “free” but that upsell them to paid products — or hit them with surprise charges.

At Intuit, “The entire strategy is make sure people read the word ‘free’ and click our site and never use” an actually free product, the former midlevel employee said. In reality, TurboTax’s Free Edition guides many people to a product that costs them money. It’s only free for people with the simplest tax situations. The “vast majority of people who click that will not pay $0,” the former employee said.

“TurboTax’s recent ads consist entirely of the word “free”

A TurboTax commercial from 2019.

Only a small portion of taxpayers, under 3 million a year, find their way to the program, far below the 100 million who actually qualify. The program is open to anyone who makes under $66,000. The IRS, meanwhile, continues to tout the program as a success, despite its decline. Internal IRS documents show agency officials unconcerned that tens of millions of taxpayers have been drawn to other “free” options.

In statements in response to questions from ProPublica, Intuit and H&R Block both said they were “proud” of the Free File program and cited the fact that millions of taxpayers have used it. They did not specifically address the employee accounts. Intuit’s spokesman said the company “created and paid for 17 marketing initiatives … to raise awareness and educate taxpayers about the IRS Free File program.” He specifically pointed to a press release on AOL.com about the program “syndicated through AOL at our expense to drive awareness.”

The H&R Block spokeswoman said the company’s Free File offering grew 8.3% this year, and “we have updated our search practices to make H&R Block’s Free File offer even easier to find.”

An IRS spokesman said the agency “continues to support the Free File program.”

At Intuit, it’s an open secret within the company that helping customers find the Free File program would be bad for business.

One former marketing employee recalled a May 2017 meeting of a marketing team at TurboTax’s San Diego headquarters. The tax filing season had just ended, and a dozen or so staffers up to the senior manager level were brainstorming. A new employee proposed that customers going through TurboTax’s interview-style filing process who were found to be eligible for Free File get a “hard recommendation” — essentially a pop-up window — to be routed to the truly free product.

The response? Laughter, according to the former employee. The meeting quickly moved on.

“They have ways of detecting if you’re paying too much, but they just don’t do it,” the former staffer said.

As a result, many people end up paying TurboTax even though they could have filed for free. The company won’t say how many people this is, but it is likely in the millions. Dozens of taxpayers have contacted ProPublica to tell their stories of being charged by TurboTax despite the fact that they earned under $34,000 a year, qualifying them for TurboTax’s Free File product. An 87-year-old retiree with a gross income of $11,000, for example, was charged $124.98 to file with TurboTax.

H&R Block tells staff to steer people away from Free File

H&R Block instructs its staff to push people toward its paid products in this internal guidance obtained by ProPublica.

At H&R Block, a former veteran staffer called it “company policy” to steer customers away from the Free File option. “The company is making money from the product, and that money is eating into the clients’ refund,” the former staffer said.

At Intuit, customers who don’t know about the Free File product will find themselves instead on the “Free Edition.” There, they are often pushed to buy deluxe versions of TurboTax they might not need. They can be charged a $39.99 “Refund Processing” fee to have the cost of TurboTax deducted from their refund instead of paying upfront. They are also sold side products such as “audit defense,” which offers expert representation in the event of an audit.

Executives who have worked at the company boast on resumes reviewed by ProPublica about their success in having diverted customers from “free” offerings to paying products.

One former marketing manager described her role as “driving new business growth” through TurboTax Free Edition “while mitigating cannibalization of our paid tax offerings.” Another senior product marketing manager boasted that she had helped develop the “monetization strategy of the TurboTax Free Edition product.” She said she applied the principles of the behavioral economist Dan Ariely to enhance “TurboTax in-product upsell experiences.”

On LinkedIn, Heather Samarin, who was a TurboTax vice president of product management a decade ago, said that she had been “charged with addressing the threat posed by IRS free efile program” and had “revamped TurboTax marketing strategy for low-end tax filers,” driving a “100% increase in revenues.” She did not respond to requests for comment.

At a meeting in 2014, Intuit’s then-Chief Financial Officer Neil Williams described the prospect of the IRS adopting a system of pre-filled returns as an “existential threat” to the company, according to the former midlevel staffer. Williams didn’t respond to requests for comment.

Last summer, according to a former marketing employee, the then-head of TurboTax, Dan Wernikoff, attended a meeting about customers who had unnecessarily selected costlier products like TurboTax Deluxe. These customers had tax situations that qualified them for a cheaper or even free product, and the slides shown at the meeting referred to them as having been “overcharged.” According to the former employee, Wernikoff instructed that going forward, employees should never use the word “overcharged.” Instead, they should say that these customers’ use of products intended for higher-earning customers was “aspirational.” Wernikoff didn’t respond to a request for comment.

The IRS’ Free File program peaked early. In 2005, its third year, 5.1 million taxpayers used the program to file a free return. That early success set the program up for plenty of growth, as every year, millions more Americans were moving away from paper to file their tax returns electronically. In 2005, only 68.5 million returns were filed electronically — about half the number filed electronically last year.

But instead of growing, Free File shrank.

Loading…

At the IRS, according to internal management reports obtained by ProPublica through a public records request, executives were ambivalent about the program’s decline. The reason for the drop was that companies “now heavily promote free options outside of IRS Free File,” said a report in November 2009. Two years later, as the numbers slid further, a report blamed the “continued migration of taxpayers to other online free services offered in the marketplace.”

By 2017, after the number of Free File users had been cut in half from its 2005 peak, IRS executives were claiming the program’s decline was instead proof of its success. As a November 2017 internal report put it: “We believe the continued decrease is a direct result of the increase in free options available in the broad marketplace. Free File has been successful in generating a free marketplace and stimulating that marketplace, perhaps to the program’s detriment.”

Yet the same report conceded that the IRS did not have a “quantitative understanding for the decrease in Free File returns” — in other words, the agency had never actually studied why or how taxpayers were lured to other options in the “free marketplace” or whether those options were actually free.

One year later, an IRS oversight panel contradicted the report’s rosy conclusions. The panel wrote that the agency “does not provide adequate oversight of the Free File program” and that by failing to have clear goals for the program or checking to make sure the companies were following through on their promises, the IRS was putting “vulnerable taxpayers at risk.” Despite the panel’s criticism, the IRS has not announced any significant reforms to oversight of the program. Last October, the IRS signed a deal with Intuit and the other companies renewing the Free File program.

Intuit’s aggressive lobbying of Congress on tax filing issues is well known inside the company, but it is a topic most employees shy away from discussing openly, according to a former Intuit engineer.

One employee recalled longtime Intuit CEO Brad Smith, a folksy leader who often invokes his roots in West Virginia, batting back a question at an employee Q&A about whether the IRS should offer Americans pre-filled tax returns. If that happened, Smith argued, the government would take advantage of people, especially those who don’t speak English. A company spokesman didn’t respond to a question about the episode.

Smith presided over a decade of dramatic growth at Intuit before he was succeeded by Sasan Goodarzi this year. Last year, Intuit’s consumer division, which includes TurboTax, reported $1.6 billion in operating income.

After ProPublica reported last month that many people had been charged even though they were eligible to file for free, dozens of readers reported receiving refunds. But in recent days, the company created a special team to handle — and deny — refund requests, according to customer service representatives working for Intuit subcontractors.

Customer service staff reported being told to blame the 2017 Trump tax law for customers being charged. Multiple readers said they’d been told that the ProPublica stories were “fake news.” Intuit has not answered repeated questions about its refund policy. A spokesman said that no material provided to call agents “included a reference to tax law changes, elected officials or derogatory terms about ProPublica.”

Meanwhile, calls to investigate the industry’s attempts to steer taxpayers away from the Free File program are growing.

This week, Rep. Katie Porter, D-Calif., wrote letters asking the IRS and Federal Trade Commission to investigate Intuit’s and H&R Block’s attempts to hide their Free File pages from search engines.

On Wednesday, New York Gov. Andrew Cuomo requested two state agencies to open an investigation. In response, the Intuit spokesman said: “Our search and marketing practices around the IRS Free File program have been called into question. These characterizations are untrue and we look forward to sharing the facts with New York regulators.”

The spokesman didn’t respond to requests to specify which characterizations were untrue.

Ariana Tobin contributed to this report.