tl;dr: Building new solar, wind, and storage is about to be cheaper than operating existing coal and gas power plants. That will change everything.

When the history of how humanity turned the corner on climate change is written, we’ll look back and see that clean energy – specifically clean electricity from solar, wind, and storage, went through four distinct phases.

RENEWABLES PHASE 1 – POLICY DEPENDENT

From the 1980s until roughly 2015, there was virtually no place on earth where new solar, wind, or energy storage was cheaper than generating electricity from coal or natural gas. This was the first phase of renewables, one where they scaled entirely because of government subsidies and mandates. And in this time, renewable growth was paltry. Solar reached 1% of global electricity. Wind reached perhaps 4%. The world spend hundreds of billions of dollars subsidizing clean energy, and seemingly got nothing.

RENEWABLES PHASE 2 – COMPETITIVE FOR NEW POWER

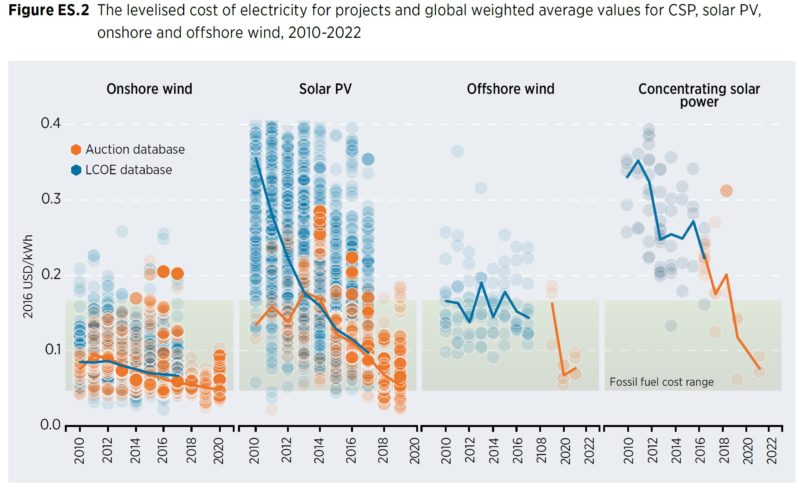

Except that the world didn’t get nothing. As I’ve written often, the most important aspect of clean energy policy has been to drive down the price of clean energy by scaling it, and thus kicking in the learning-by-doing that continually lowers the unsubsidized price of new solar, new wind, and new energy storage. The policies of the 80s, 90s, 2000s, and 2010s finally drove down the cost of new solar and wind electricity by more than a factor of ten. That finally paid off around 2015, when, for the first time, building solar or wind power was, even without subsidies, sometimes cheaper than building new coal-or-gas fired electricity.

You can see this in IRENA’s graph showing the price of new solar PV, on-shore wind, off-shore wind, and solar CSP.

RENEWABLES PHASE 3 – DISRUPTIVE TO EXISTING FOSSIL ELECTRICITY

Now, after decades of subsidizing solar and wind, we’re on the verge of a new, radically different point in history – the point at which building new solar or wind power (or new energy storage systems, in some cases), is cheaper than the cost of continuing to operate existing coal- or gas-fueled power plants.

Dubious? Consider the following:

- NextEra CEO: Cheaper to Build Solar & Wind Than Operate Existing Coal by the Early 2020s: In January 2018, NextEra CEO Jim Robo told investors that by the early 2020s, it would be cheaper to build new solar and wind power than to operate the utility’s fleet of existing coal power plants.

- NIPSCO: Cheapest Option is to Go from 65% Coal-powered to Zero – and Replace it With Solar, Wind, and Storage. In October of 2018, a utility in Northern Indiana, NIPSCO, reached Jim Robo’s prophesied point years ahead of schedule, when it submitted a 5 year resource plan that would take the region from being 65% coal powered in 2018 to just 15% coal powered in 2023, and 0% coal powered in 2028, and replace virtually all of that coal power with a mix of solar, wind, storage, and flexible demand. Bear in mind that NIPSCO is in a region with mediocre sun, pretty good but not amazing wind, and which voted for Donald Trump by 19 points. Admittedly, this is with prices of solar and wind which are still somewhat subsidized in the US. But not tremendously so, as the US federal solar and wind tax credits (the ITC and PTC) are winding down in exactly this same period.

- 2019: Florida Power and Light: Cheaper to Build New Solar + Storage Than Operate Existing Gas Plants. In March of 2019, Florida Power and Light said it would retire two aging natural gas plants, and replace them with a combination of energy efficiency and the world’s largest (so far) battery, which it will use to charge with solar power during the day to deliver during the evening peak.

-

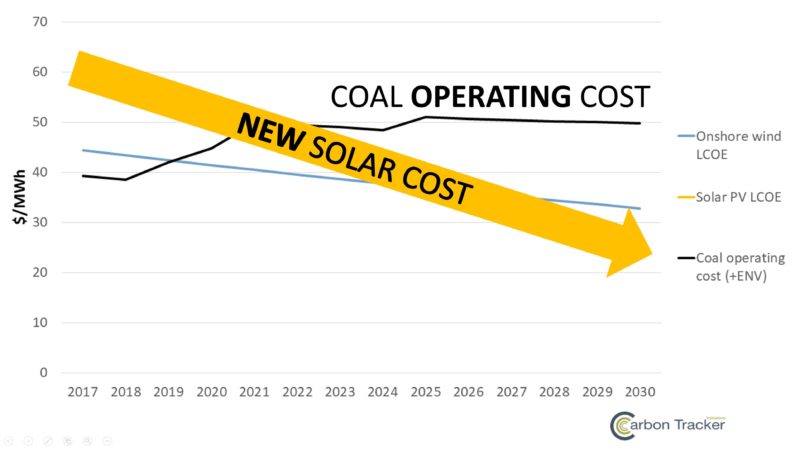

CarbonTracker – New Wind and Solar Cheaper than Existing Coal and Gas in the US, China, and India by the mid-2020s. Meanwhile, think tank CarbonTracker has been quietly pumping out reports showing that in country after country, new solar and wind are headed for prices cheaper than the operational cost of existing coal and gas. Consider this chart (slightly modified by yours truly) of new solar and wind cost in the US vs coal operational cost:

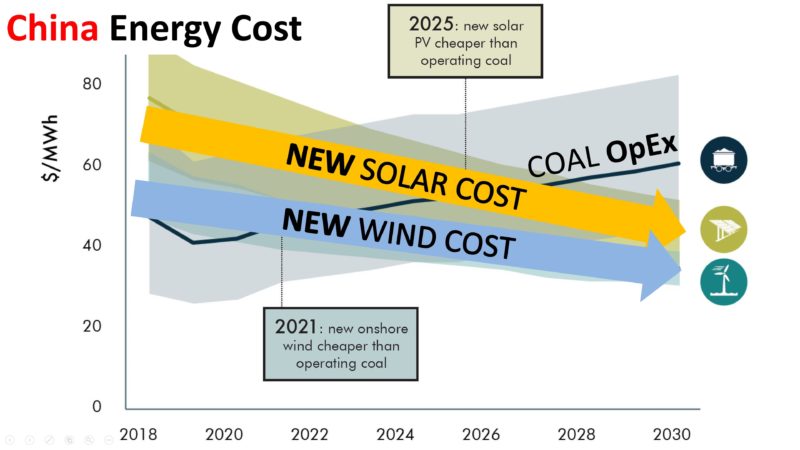

See CarbonTracker’s report on the disruption of Coal in the US for more: No Country for Coal Gen. Or, more importantly, consider what CarbonTracker forecasts for China: That new solar and wind will be cheaper than the operating cost of existing Chinese coal power plants by the 2020s. See more at CarbonTracker’s report on China’s coal fleet, “NoWhere to Hide“

See more at CarbonTracker’s report on China’s coal fleet, “NoWhere to Hide“ -

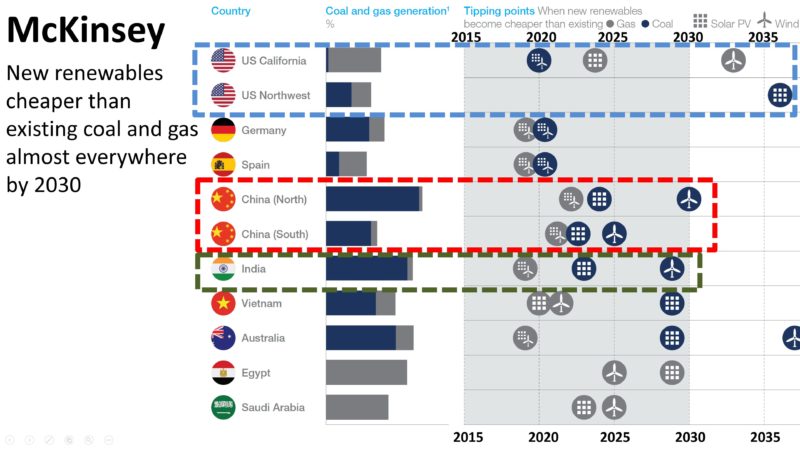

McKinsey: New Solar and Wind Cheaper than Existing Coal and Gas… Pretty Much Everywhere by 2030.

Finally, if reports from CarbonTracker, or announcements by actual utilities aren’t enough, consider McKinsey’s assessment from its Global Energy Perspective 2019. In the chart below (with a bit of help from me), McKinsey shows that on almost every continent, and particularly in China and India, where energy demand has the most to grow, new solar and wind are cheaper

than existing coal and gas by 2030. And often much sooner.

We’ve gone from Phase 2 to Phase 3 much more rapidly than we went from Phase 1 to Phase 2. Why? Because solar and wind power had to drop by a factor of nearly 10 in price – from 60 cents / kwh for new electricity to roughly 6 cents / kwh for new electricity – to move from their early days to being competitive for new power. But they only have to drop by another factor of 2 or 3 to move from being competitive for new power to being cheaper than the operating cost of existing coal and gas. The “competitive zone” is much narrower and faster to pass through than the long history of subsidized prices leading up to the first fair market competition.

RENEWABLES PHASE 4 – SLOWED BY HEADWINDS

Finally, there will in fact be a Phase 4 of renewables, when their penetration has grown so high that they become limited by headwinds of their own creation: Value deflation, where renewables create so much supply at certain hours that they drive down wholesale prices; Depletion of the best sites in some regions; Seasonal intermittency and the unsolved problem of seasonal storage.

But these problems are distant. Renewables will start to encounter them in earnest when solar makes up >20-30% of electricity and when wind makes up >40-50% of electricity. Today, worldwide, solar is only 2% and wind is only perhaps 6% of global electricity. Cheap multi-hour storage will arrive before that (indeed, in the next few years), lowering the price of using solar to meet the evening peak, and of dealing with intermittency on the order of minutes to several hours. Only seasonal storage (and perhaps the political challenges of long-range transmission) seem to be truly difficult problems. And we have time before they begin to impair the growth of renewables.

WHAT THE THIRD PHASE MEANS FOR RENEWABLE GROWTH RATE

I’ve said often that renewables have grown exponentially. But the truth is that wind power growth rates around the world have slowed substantially. And solar power, once growing rapidly in Europe, has stagnated there over the last several years (at least, until a recent growth spurt spurred by solar entering Phase 2 in parts of Europe in the last year.)

But growth rates up until now are largely irrelevant. The whole point of growing renewables has been to drive down their cost. The actual amount of solar and wind that policies have deployed up until now is almost immaterially small. It just isn’t enough to matter. What matters is that policies up until now have driven down the cost of solar, wind, and energy storage by more than an order of magnitude.

If those policies – and the fact that renewables are now competitive for new power even without subsidies in the sunny and wind parts of the world – continue for long enough for renewables to drop another factor of 2 or 3 in price – on top of the factor of 10 or more that they’ve fallen already, then we’ll enter a new domain where renewable growth rates aren’t determined by fickle policy. Instead, they’ll be limited only by the pace at which renewables can be deployed – the pace at which factories for solar panels, wind turbines, and batteries can be built; the pace at which labor forces can be trained to deploy them; the pace at which capital can be deployed to pay for their installation.

How fast is that? I have no idea. But there’s good reason to believe that in this second and third phase of renewables, the growth rate will accelerate rather than slowing. We will look back and see that the growth of renewables is an S-curve to be sure. But we may also look back and find that, as of 2019, we had not yet hit the first upward swing in that S-curve.